Money Matters in Private Practice: What Therapists Are Focused on in 2025

A new year often brings reflection—and for therapists in private practice, 2025 is clearly about rethinking financial priorities. According to The 2025 Financial State of Private Practice Report by Heard, a nationwide survey of over 3,000 therapists revealed some telling trends about money, mindset, and private practice sustainability.

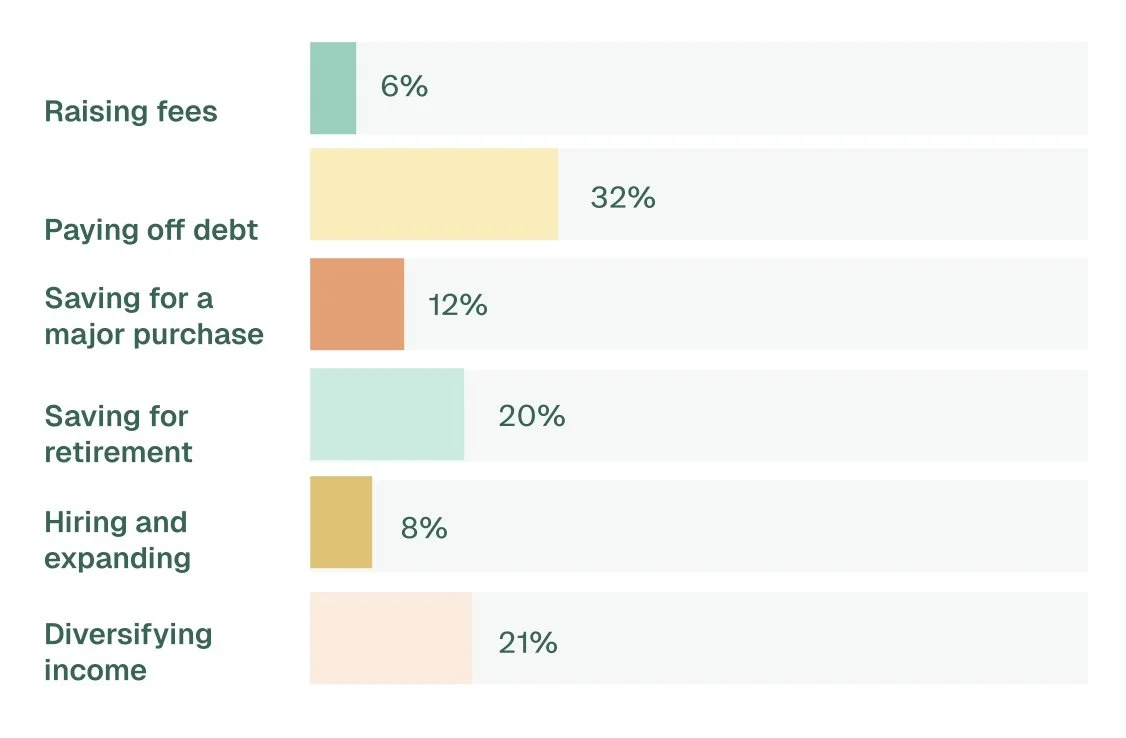

The Top 3 Financial Goals for Therapists in 2025:

32% are focused on paying off student loan debt

21% want to diversify their income streams

20% are prioritizing retirement savings

These goals reflect not only financial needs but also the emotional weight therapists carry when it comes to money. Despite inflation and rising operational costs, 58% of therapists say they have no plans to raise their fees this year—a statistic that opens the door to a deeper conversation around money stories, money scripts, and even avoidant behaviors around money.

As mental health professionals, therapists are deeply attuned to the emotional patterns of others. But when it comes to personal finances, many still struggle with money taboo, feelings of guilt around raising rates, or a hesitation to treat their practice like the business it is. These internal scripts—often unconscious—can quietly undermine long-term financial well-being.

This data invites therapists to reflect:

What is your current money story?

Are you avoiding financial decisions out of discomfort or uncertainty?

How might exploring your own money mindset shift the way you approach your practice?

Understanding these patterns is not just about numbers—it’s about meaning, sustainability, and care. In future posts, we’ll explore topics like setting fees with confidence, making space for retirement savings, and how financial countertransference can show up in session.

This is the beginning of an ongoing conversation around money and mental health—one rooted in curiosity, reflection, and empowerment.